A thick blanket of gloom descended on the stock market on Monday as investors watched the KSE-100 index crash through the 32,500 points barrier to finish with a loss of 474.18 points or 1.44 per cent at 32,454.91. Heavy foreign selling and steep decline in oil and gas stock prices pulled the market down to the lowest level seen in 2015.

“The KSE-100 Index is presently hovering near 2014 year-end levels and almost all gains witnessed in 2015 have been wiped out,” lamented brokerage Topline Securities in its daily report.

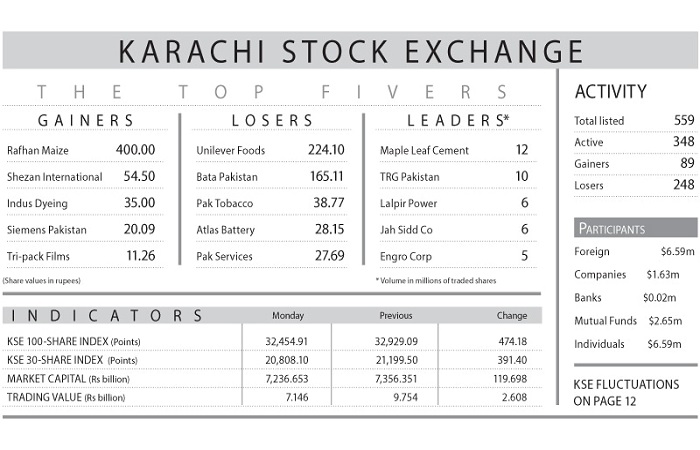

Foreign selling continued unabated on Monday with net outflow of $6.59m and major sell-off in ‘chemicals’ sector.

“Net foreign selling to-date this year amounts to $99m despite positive economic and political outlook of the country,” Topline analysts said.

On Monday, 12 of the 13 listed oil stocks plunged on the back of further slide in global oil prices.

Index heavy weight OGDC was down 2.6 per cent, while PPL, POL and PSO declined 2.3pc, 1.8pc and 2.0pc, respectively. Volume of shares traded dwindled on Monday to 120m shares with trading value at Rs7.2m, which compared to YTD average daily volume of 249m shares and average traded value at Rs14bn.

Analyst Ahsan Mehanti commented that investors were jittery after major fall in WTI crude oil prices below $45/barrel and rumors of expected institutional selling on weak earnings outlook in oil sector.

“Investors expected consolidation post major earnings announcements amid hopes for ease in SBP Key Policy Rates to be announced on March 21 and expectations of early resolution of broker concerns on SECP regulations,” analyst said.

Investment analyst Ovais Ahsan observed that the market opened the week on a negative note as fear of continued foreign selling spooked local investors.